Integrate PayEm with your eligible American Express® Business or Corporate Card

It’s easy to make payments, manage expenses, and empower employee spending – all while earning the rewards of your American Express Card when making virtual Card payments.

Enrollment is required and fees may apply

With PayEm, there are even more reasons to love your Card

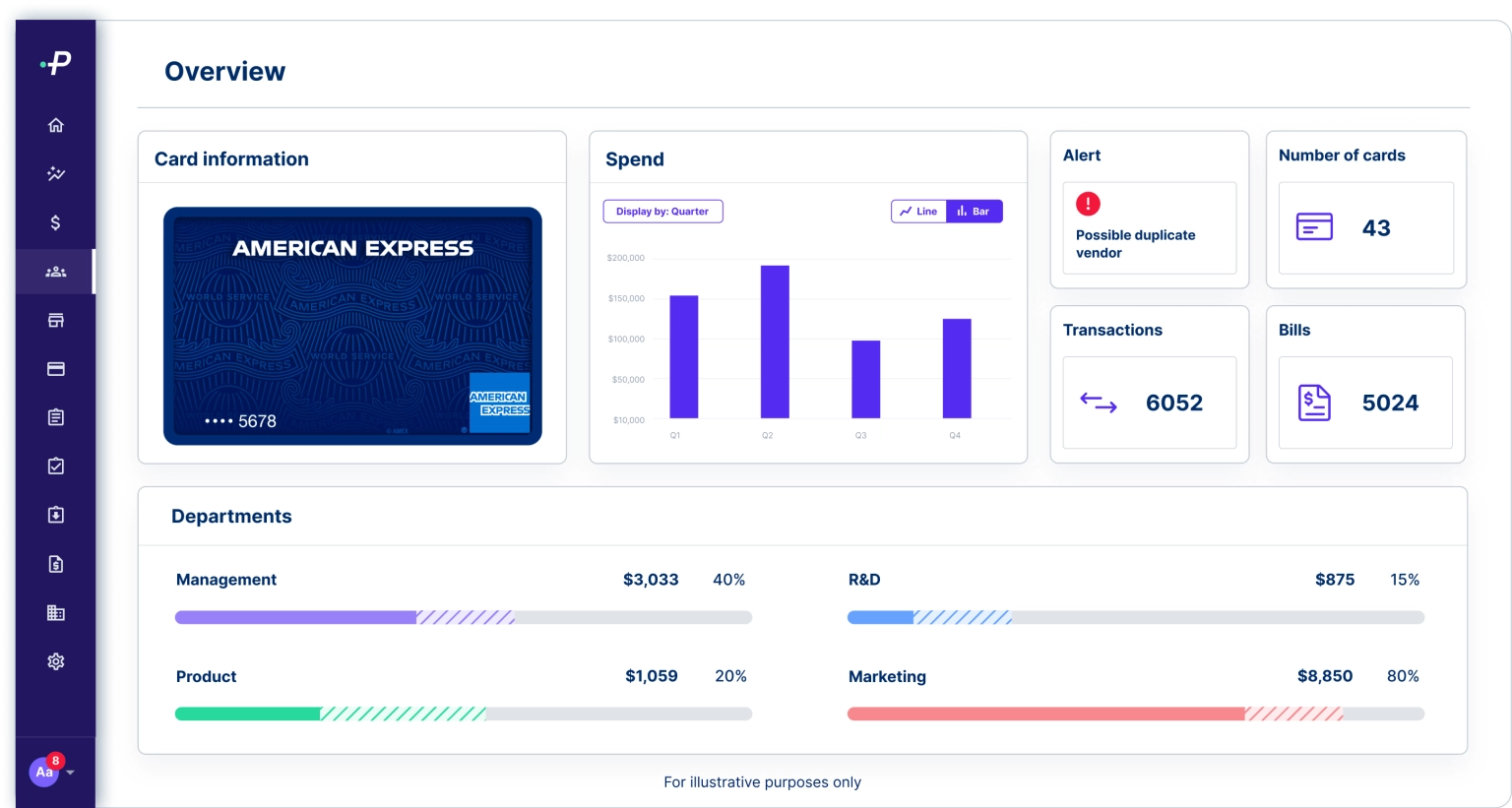

PayEm’s software platform and mobile app allows you to create and send virtual Cards using your American Express® Card. Enrollment Required. When you add your eligible American Express Card to PayEm to make payments, you can earn the same rewards you currently earn, but with the added benefit of managing your spending in one place.

With enrollment, customers can create American Express virtual Cards on the PayEm platform, providing visibility and control within your spend management process. Employee requests are routed to the right approvers, with budget control for informed decision-making, and transactions are synced to your accounting system. PayEm provides a seamless and intuitive way to help manage payments while earning the rewards of your eligible American Express Card.

Save Time & Streamline Expenses

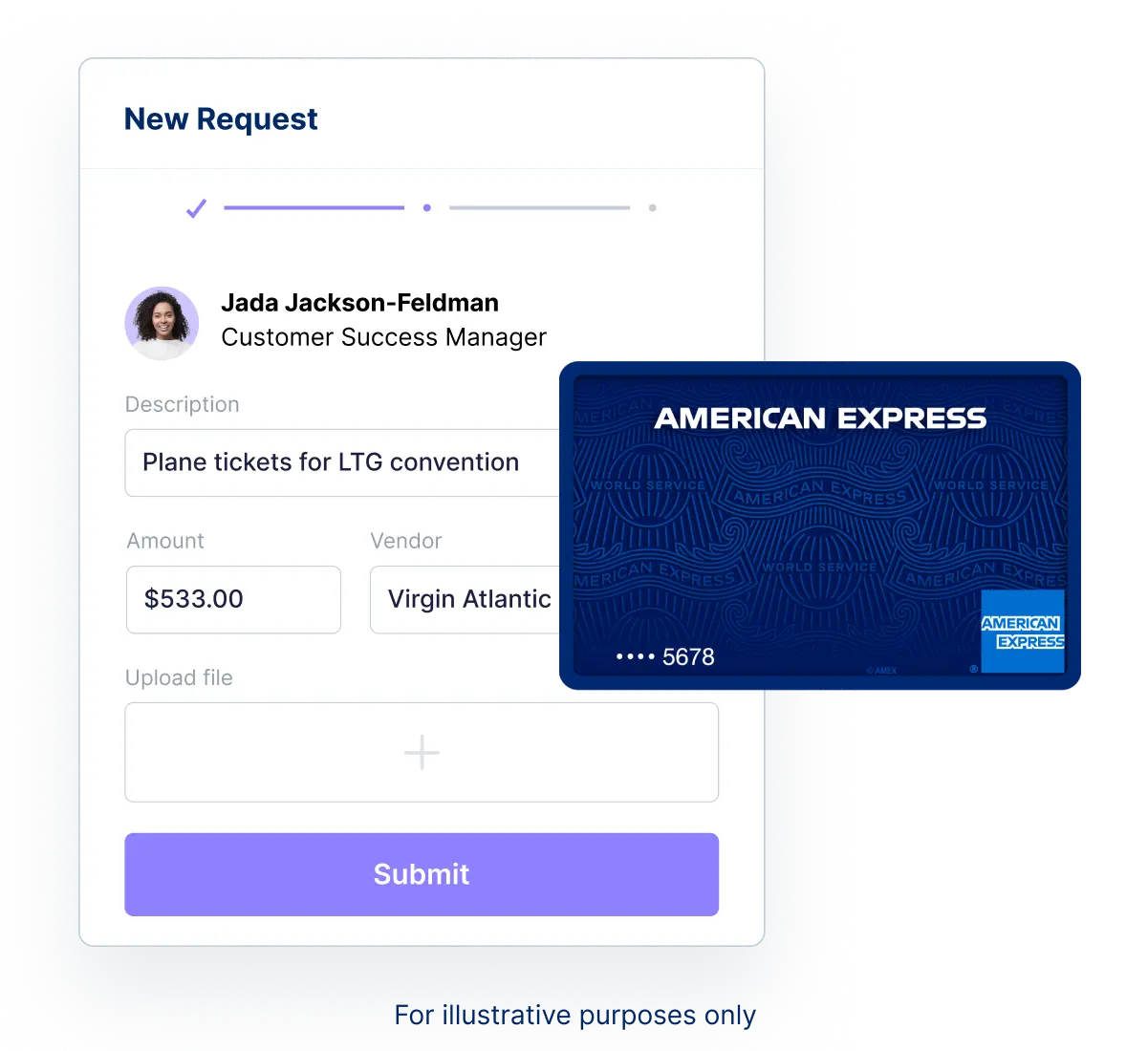

Give your employees time back through simplified expense management.

Automate reimbursement filing for employees by giving them on-demand virtual Cards for one-time or recurring expenses such as meals, business travel, or office supplies

Create project-specific on-demand virtual Cards to manage marketing, technology, advertising, or social media subscriptions

Manage budgets specific to projects and maintain visibility and control over spending with spending limits and expiration dates

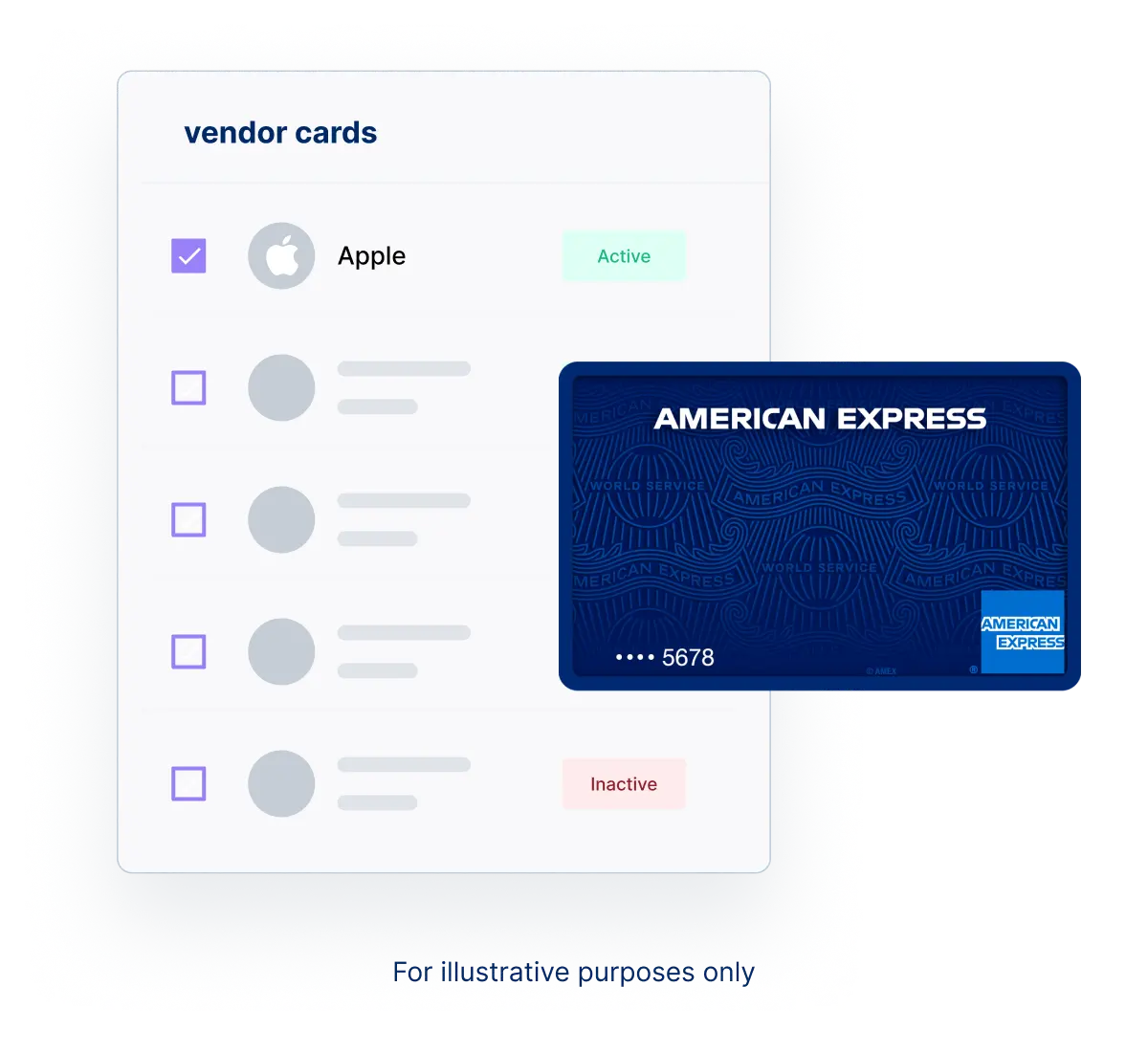

Organize spending with unique virtual Cards by employees, clients, projects, vendors, or other expense categories

Gain Control

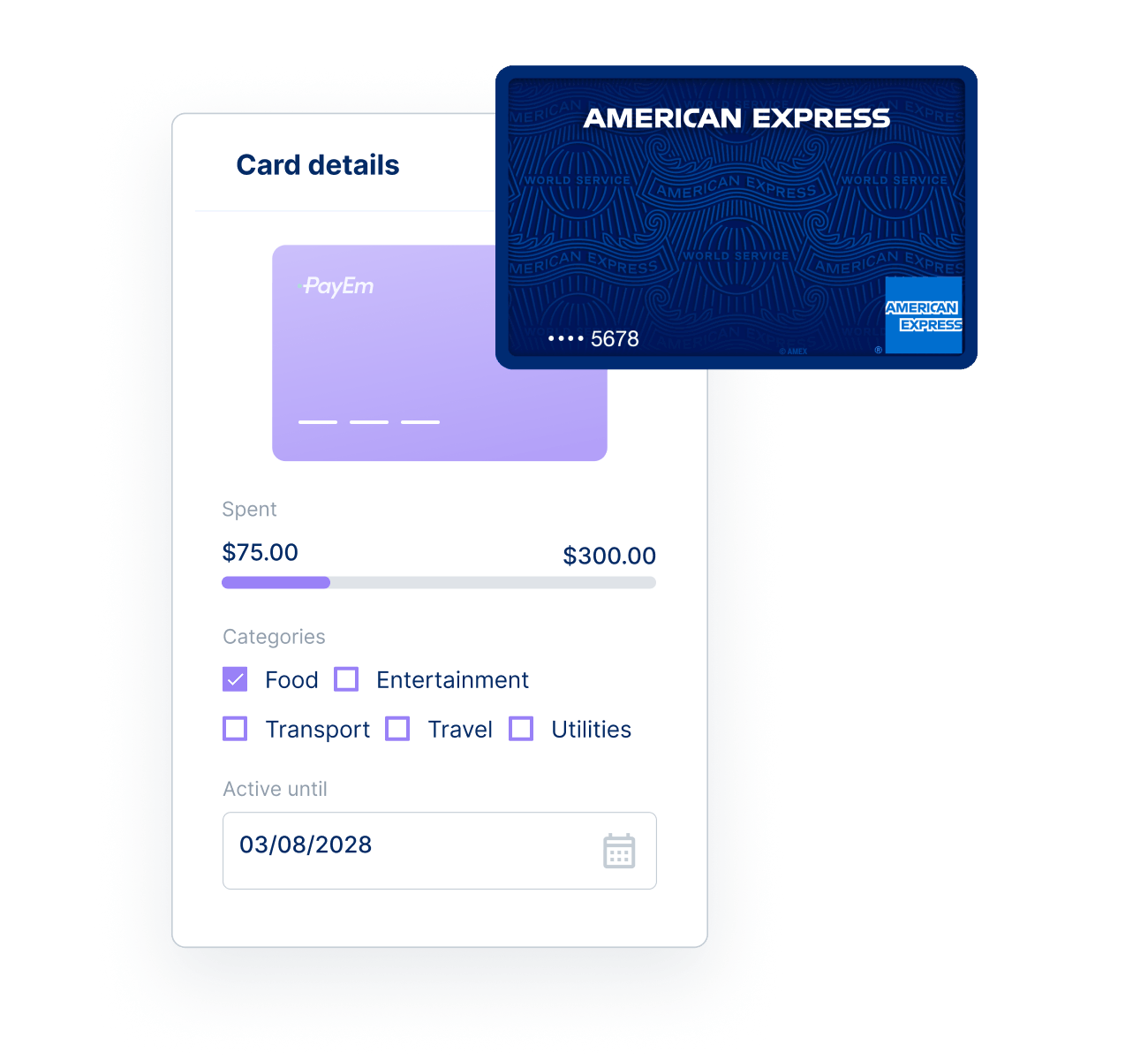

Virtual Cards offer enhanced control & visibility into your payments

- Establish specific controls for each on-demand virtual Card payment, including spending limits, expiration dates, and allowed merchant categories

- Approve, modify, or cancel virtual Cards at any time

- Create budgets specific to your projects and maintain visibility and control over spending

- Enable employees, freelancers, and subcontractors to make payments on your behalf without sharing your physical Card

Enhance security

Pay with enhanced security

- Vendors receive a virtual Card number, not the actual Card

- The virtual Card number provides added security because it is a token good for a specific transaction, purchase amount, and time period

- Remove the need for merchants to see or store their underlying m Card account number

Integrate your American Express Card with PayEm in Minutes

Step 1

Log into the PayEm platform

Step 2

Fill out a simple form

Step 3

Log into your American Express business account

Step 4

Connect your American Express Card with your PayEm account

To generate American Express virtual Cards through PayEm, you must be an American Express Corporate, American Express Corporate Purchasing, or American Express Business Card Member. Separate enrollment with PayEm and American Express is required to utilize combined product offering. To make an American Express Card payment to a vendor through PayEm, the vendor must be an American Express accepting merchant. There is no fee to generate American Express virtual Cards. Certain features, upgrades, and additional payment methods may require separate activations and fees may apply. PayEm is solely responsible for determining any and all fees associated with their product. Please contact your PayEm representative to learn more.

1 Not all Cards are eligible to get rewards. Terms and limitations vary by Card type.

Step into the Future of Finance

Say goodbye to bottlenecks. Experience the future of financial workflows with PayEm.