Smart Physical Cards for Modern Businesses

Combine the convenience of traditional cards with powerful, modern controls. Issue physical cards to your team with customizable spending limits and usage windows. Enjoy enhanced security and real-time expense tracking, all while empowering your employees with a flexible spending solution and earning cashback on all transactions.

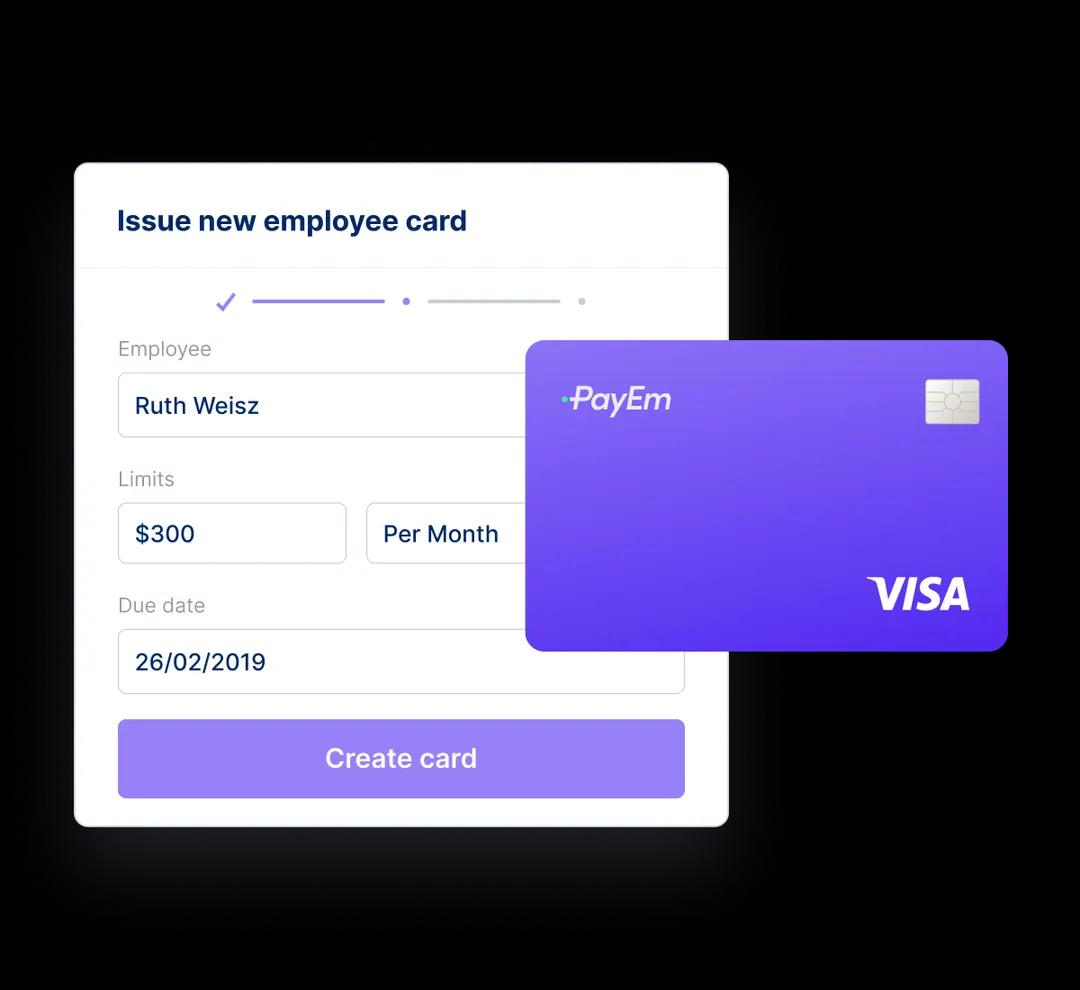

Physical Card Control, Your Way

Swiftly issue physical corporate cards through PayEm, tailored to your rules. Set budgets, usage dates, and card types as per your needs. Provide cards to employees confidently, ensuring budget adherence and real-time tracking.

Total Visibility & Flexibility

Create physical cards for secure in-person and online payments, giving you complete control over budgets and expenses.

Customizable & Convenient

Tailor physical cards to your needs, eliminating payment struggles and ensuring budget control and tracking.

Enhanced Security

Physical cards with preset limits, PIN protection, and comprehensive fraud protection measures keep your funds secure.

Effortless Expense Management

Snap and upload receipts, set spending rules, and manage budgets in real time for seamless tracking.

Tailored Budget Management

Allocate physical corporate cards to specific budgets or purchase orders, providing fine-tuned financial control. This prevents overspending, streamlines resource allocation, and boosts financial planning accuracy. Whether for projects, departments, or initiatives, align your spending precisely.

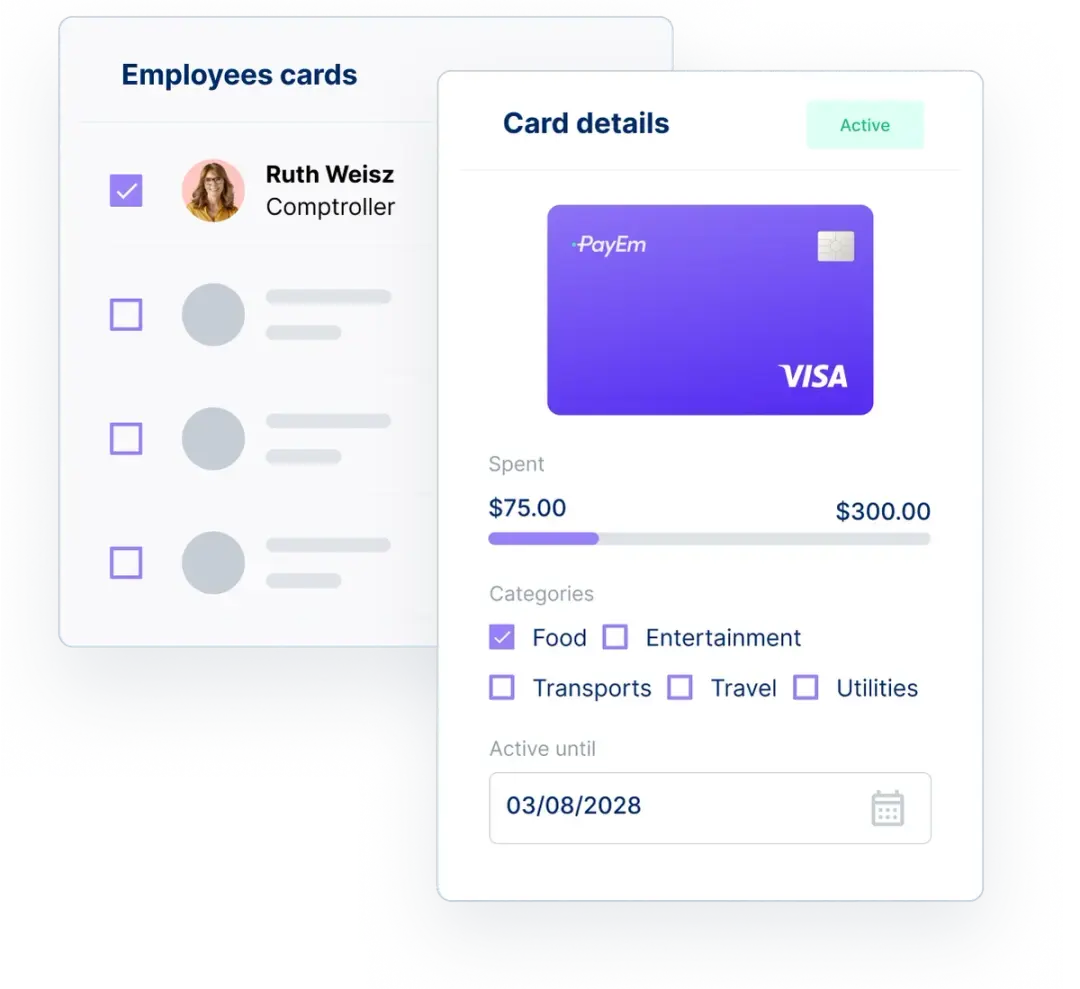

Built-in Spend Controls

Implement airtight controls on physical card spending, vendors, or timing. Dictate spending parameters that align with your business strategies and policies. Manage transactions effortlessly and set limits that ensure adherence to budgets. With granular controls, maintain fiscal discipline without complications.

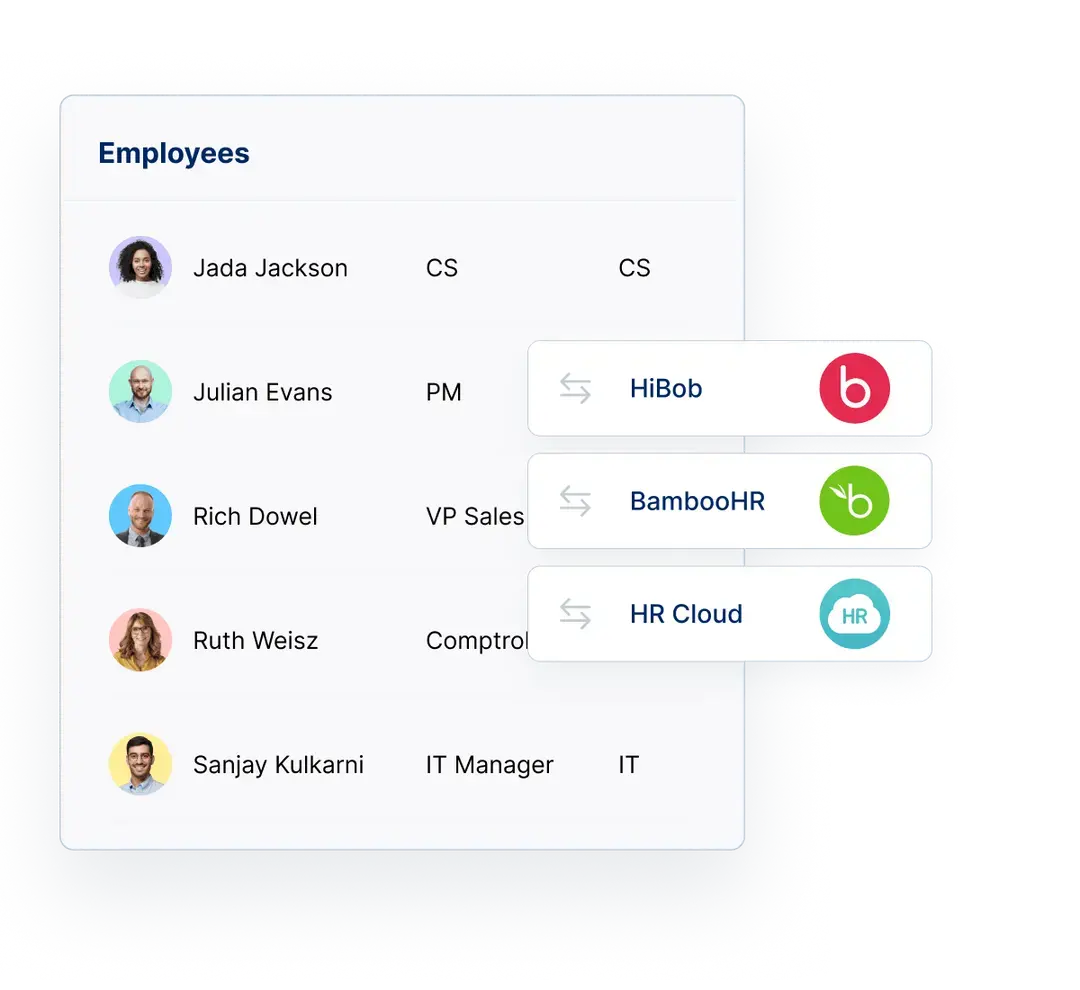

Seamless Integration with many HR Systems

Bolster security and efficiency through seamless HR system integration. When employees leave, rest assured that their physical cards are promptly deactivated, minimizing risks. This integration ensures a smooth transition, allowing you to manage cards effortlessly, strengthen compliance, and safeguard resources.

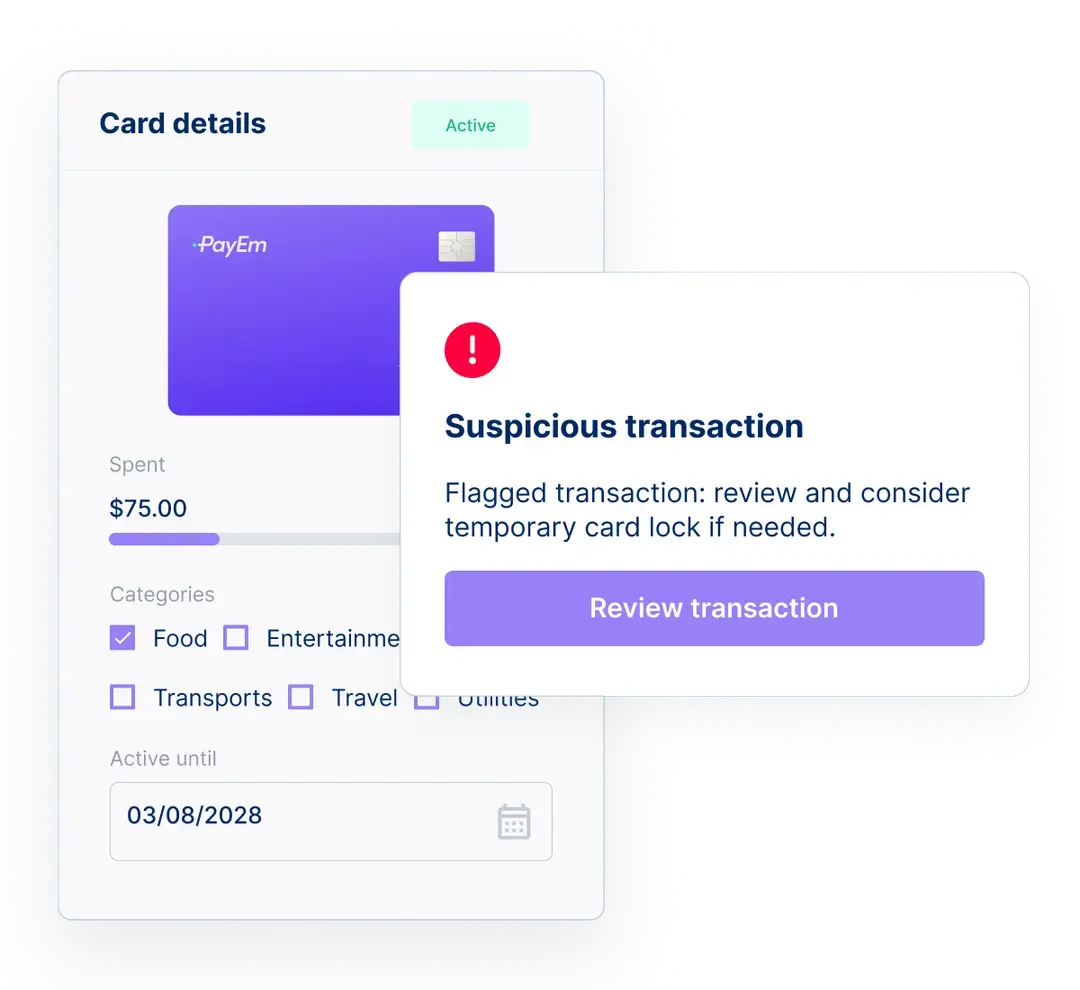

Fraud and Error Reductions

Elevate your financial security with advanced anti-fraud mechanisms for physical cards. Our system's vigilant monitoring and controls provide a robust defense against unauthorized spending and errors. Real-time alerts enable swift action against suspicious activities, preserving your financial integrity.

Effortless Expense Tracking

Free yourself from manual receipt tracking with effortless expense management. Capture receipts seamlessly through snapshots or uploads, eliminating the hassle of chasing paper records. This saves time, reduces administrative burden, and enhances accuracy in expense recording.

Real-Time Insights & Reporting

Elevate decision-making with immediate insights through real-time reporting. Stay informed about physical card usage, spending trends, and financial patterns as they unfold. This empowers you to make timely adjustments, capitalize on opportunities, and maintain a proactive financial stance.

Great system that combines credit cards, account payables, purchase orders and expense reimbursement. PayEm combines all expense procedures in one system, it's straightforward, intuitive, quick, saves time, and syncs easily to the ERP systems. It is very recommended.

Yana Fridman

VP of Finance, Vi Labs

Corporate Cards FAQ

Find quick, clear information to help you manage your corporate cards effectively.

How do corporate cards work?

Corporate cards streamline business expenses, offering employees a convenient payment method. With preset credit limits and expense tracking tools, they simplify financial management, providing businesses with monthly summaries and flexible reimbursement options.

What are corporate cards?

Corporate cards are specialized credit cards for businesses, facilitating streamlined expense management. Tailored for corporate use, they come with preset spending limits and expense tracking features and offer businesses a centralized solution for employee spending.

What is the difference between a corporate card and business card?

A corporate card is tailored for business-wide expenses, offering centralized control and robust tracking, primarily for larger enterprises. In contrast, a business card encompasses a broader range, including personal cards used for business and dedicated business credit cards, catering to diverse business sizes and needs.

Upgrade your financial tools today.

Upgrade your financial tools today. With us, you can discover the future of physical corporate cards and experience a new level of efficiency and control for your business.