PayEm vs. Stampli

PayEm’s platform takes P2P and AP automation further, offering the payment method of your choice, receipt collection, reconciliation, and ERP sync – all within the context of a PO.

Why PayEm is the choice over Stampli

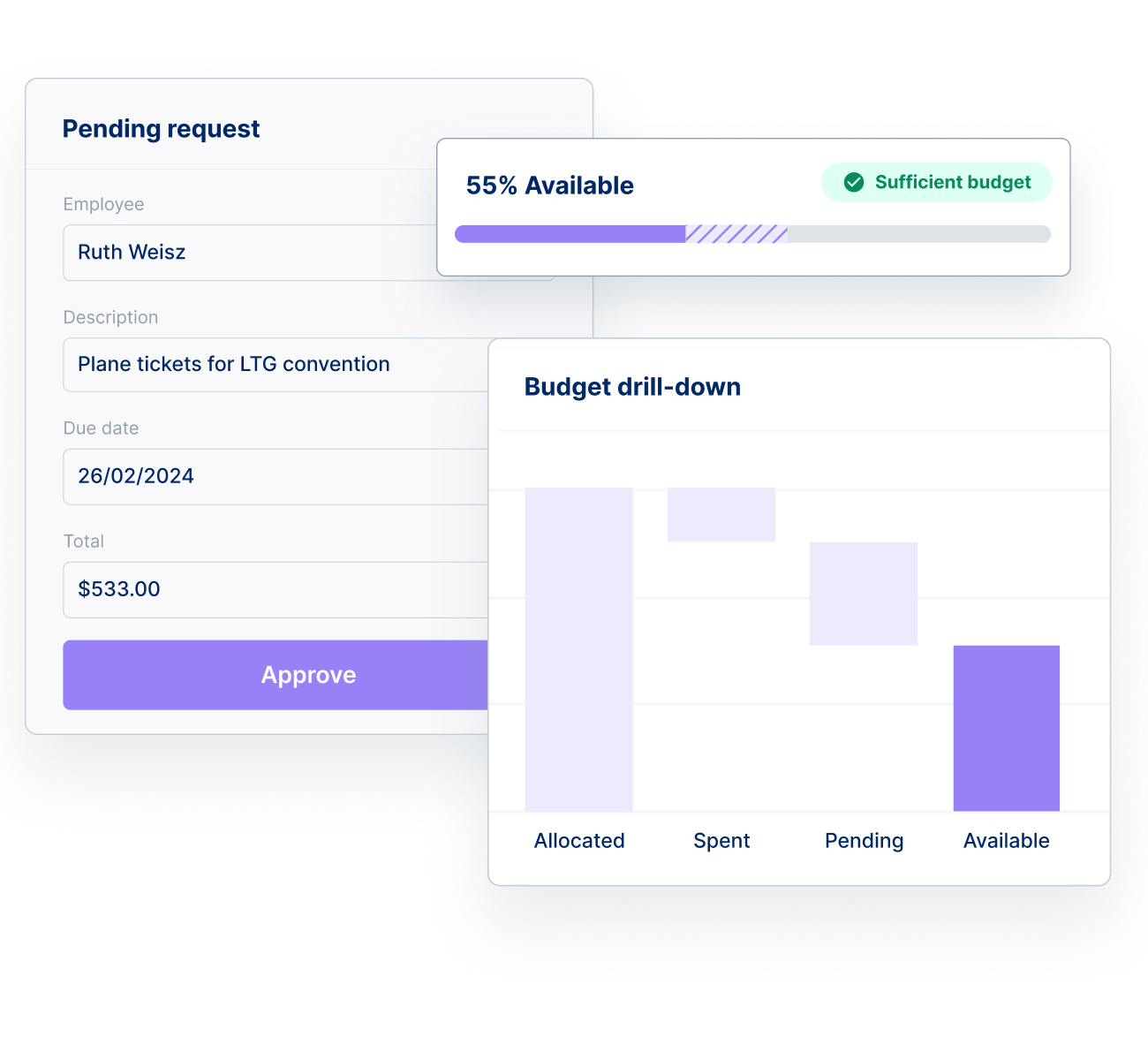

Unprecedented Visibility

Immediate visibility into actual versus budgeted spend, including in-process payments

Informed Decision-Making

A centralized and comprehensive view for proactive decision-making and prompt actions.

Budget Owner Accountability

Budget owners can access all relevant information, reducing reliance on the finance team.

See how PayEm and Stampli compare

| PayEm | Stampli | |

| AP Automation | ||

| ERP Integration | ||

| Designated Employee Cards | ||

| Subsidiary Management | ||

| Custom Approval Flows | ||

| Support for 180+ currencies/territories | ||

G2 Score | 4.8 | 4.7 |

PayEm has helped us save about 75-80% of the time we used to spend on AP tasks. Beyond the time-saving, we've implemented approval workflows, which give us clearer visibility and better tracking.

Alan Michael

Senior Director of Finance, TravelNet Solutions

Stay Ahead with Real-Time Budget Insights

Transition from Excel and traditional tools and navigate past the limitations of ERP modules. Embrace PayEm's dedicated budget planning tool for enhanced efficiency and collaboration.