November 15, 2022

Financial Strategies To Recession-Proof Your Business

Sign up for our newsletter

Stay informed with the latest trends and best practices in finance and procurement.

We’ve seen this movie before. As the opening credits roll, we see a gauzy montage showing a booming economy. People are spending. There are airy predictions that good times will last forever.

Then a bank crashes. A cartel jacks up the price of oil. Sub-prime mortgages tank. A pandemic hits. Or a war begins. And times get hard. Major businesses go under. People curb their spending, exacerbating the economy’s woes. That cheery prosperity montage fades into scenes of hardship – and even desperation.

But then the economy sputters to life again! New industries lead the way. Corporations adopt new ways of conducting business, implement better management techniques, and introduce unique new products. And the boom times begin again as the closing credits roll.

We’re somewhere in the middle of this movie today. The economy continues to reel from the shocks of a global pandemic, supply chain snafus, a land war in Europe, a teetering stock market, and alarming inflation that erodes consumer purchasing power. It can be hard to resist the urge to panic.

But no one knows precisely where we are in the boom-and-bust cycle. Maybe we can take heart from the knowledge that periods of economic hardship seem to be getting shorter. What we do know from studying past recessions is that recoveries are led by gutsy companies that are willing to bet on a more prosperous future. Here are the steps many followed to make it through a downturn and emerge ahead of the game when the economy improves.

This article will cover the following topics:

- Prioritize your customers

- Control costs

- Expand into adjacent products and services

- Improve your cash flow

- Innovate!

- Invest in technology

- Recession-proof your business with PayEm

Prioritize your customers

As Jeff Bezos famously put it, obsess over your customers. He said that before the Great Recession of 2008 and continued to say it even as the economy cratered. In a recessionary period, prioritizing your customers means stressing quality over quantity.

So make sure you don’t slow order fulfillment, skimp on product quality, or cut back on customer service. Maybe your customers can’t spend much today. But when the economy recovers, they will likely remain loyal to the companies that made life during the hard times a little easier.

Control costs

During a recession, when consumers keep their wallets shut, they may have no choice but to reduce expenditures to meet continuing financial obligations.

The key here is to find ways to cut costs surgically and intelligently rather than implementing across-the-board reductions. Above all, don’t cut so much that innovation and customer service suffer. The key to understanding what can be cut safely is seeing your company’s expenditures in real-time – a topic we’ll return to below.

Expand into adjacent products and services

Perhaps the economic uncertainty we’re facing now has convinced you to shelve some of the new product ideas you had high hopes for. But here, too, there are smart and not-so-smart ways to wield the budget scalpel. As you look for cost-effective ways to continue to expand your product line, think more about adjacent products and services than wholly new ones.

Adjacencies generally cost less to develop and market than entirely new product lines. Suppose your company is well-known for selling hamburgers. A period of economic uncertainty might not be the best time to begin selling auto parts. Instead, consider developing some adjacent products like a shawarma sandwich or a spinach pie. These will be less expensive to develop and launch than a completely unrelated product line.

Improve your cash flow

Liquidity is one of the most important defenses you can have against a recession. It’s hard to sell illiquid assets when the economy is heading south, and generally more expensive to borrow.

Let’s look at the Big Three American automakers for a lesson in how vital cash can be in an economic slowdown. During the Great Recession, General Motors and Chrysler were so cash-strapped that they were forced to declare bankruptcy in 2009. But Ford survived because it had the foresight to open large lines of credit the year before the recession hit hard. The lesson is clear: cash is essential to survival when the economy falters.

Innovate!

Just above, we suggested that it may not be a good idea to launch whole new product lines during a recession. But that doesn’t mean that you should stop innovating. Apple introduced the iPhone in 2007 during the Great Recession. Going back further, the first consumer television sets were introduced during the Great Depression by Telefunken in Germany and RCA in the United States.

Admittedly it takes guts – or at least an abiding faith that the economy will rebound – to introduce innovative new products during an economic downturn. But those who do will be well-positioned to capture a significant market share for new products when the downturn ends. More cautious competitors, however, will miss out on the pent-up demand for new products when people start spending more freely again.

Invest in technology

Understanding how to ride out an economic slowdown often requires information. What’s selling and what’s not? What’s making a profit, and what’s losing money? And above all, where is the company’s money going?

Most of your company’s financial records are probably kept electronically. Gone are the days of the enormous leather-bound ledgers presided over by a team of bookkeepers. But just because your financial records are kept on a computer doesn’t mean they’re any more accurate or up-to-the-minute than paper ledgers. Mistakes happen, especially when employees with expense accounts manually enter their charges into a spreadsheet from a computer or a phone. Overspending is more likely to occur when expenses aren’t tracked in real-time and when there aren’t solid spend controls in place.

So one of the best tech investments a company can make to prepare for rough economic weather is to acquire an expense management system that gives management a view of how money is being spent and possesses built-in safeguards against overspending.

Recession-proof your business with PayEm

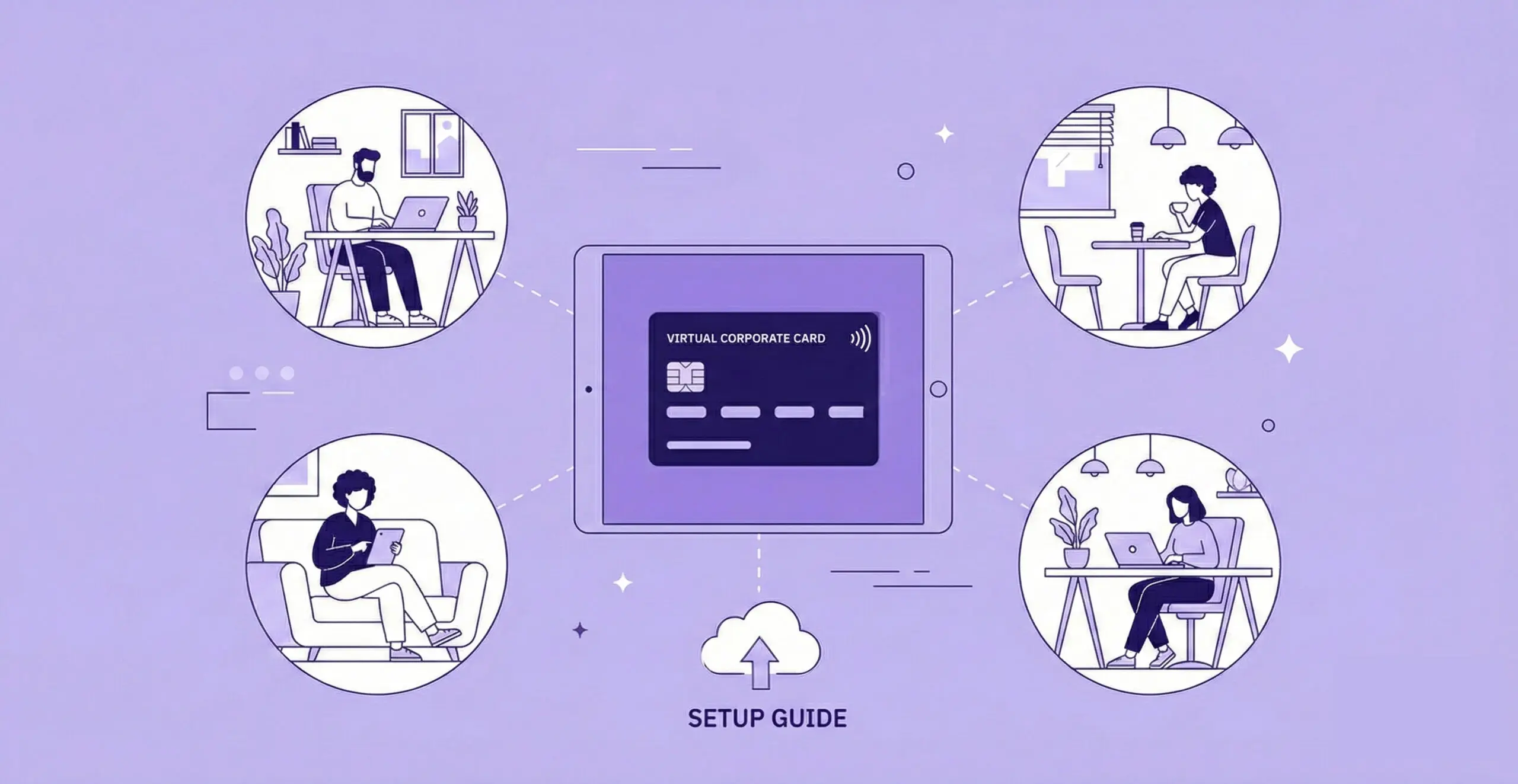

Getting up-to-the-minute information about where a company’s money is being spent is vital, both in good times and bad – but it’s arguably more important when every penny must be kept in-house for as long as possible. And this is where PayEm's spend management and procurement capabilities can help.

- It helps you cut costs with a scalpel, not a cleaver, so customer care can be maintained

- It frees up scarce funds to help you expand your product line into adjacent goods and services

- It improves your cash flow and helps you endure the cash crunches

- It enables you to fund innovation so that the company is ready to thrive when the economic clouds disappear

- It funds investments in technology

- It ensures that every dollar going out the door benefits the company in some way

Working with PayEm doesn’t mean you have to learn a whole new ERP system. PayEm integrates easily with Netsuite and other resource management software. In rough economic times, it provides management information with vital real-time insight into the company’s expenditures and budget targets that will help you weather the storm. For more information, click here to schedule a free, no-commitment demo.